The Italian-Egyptian Debt Swap Programme is one of the most important cooperation facilities between Italy and Egypt, both for the significant value of resources mobilized, and for the strong local ownership.

The Programme was established in 2001, with the signature of the first Debt-for-Development Swap Agreement between the two Governments, worth 149 million USD of debt generated from concessional loans converted into resources to finance fifty-three initiatives, in multiple sectors such as environmental protection, cultural heritage, rural development, small and medium enterprise development, education, social protection, etc.

Leveraging on the success of the first phase, a second agreement, signed in 2007, enabled the conversion of an additional 100 million USD of debt. These resources were destined for the implementation of thirty-one projects focusing on human resource development, technology transfer, primary production development, environmental protection, and social development.

The current phase of the Programme is established by the third Agreement, signed on May 10, 2012, which provides for the conversion and subsequent cancellation of the instalments of official debt assistance (ODA) owed by Egypt during the period 2012-2021, equivalent to USD 100 million and corresponding, specifically, to loans previously granted by Italy for EUR 13,087,911 and $USA 82,755,369.

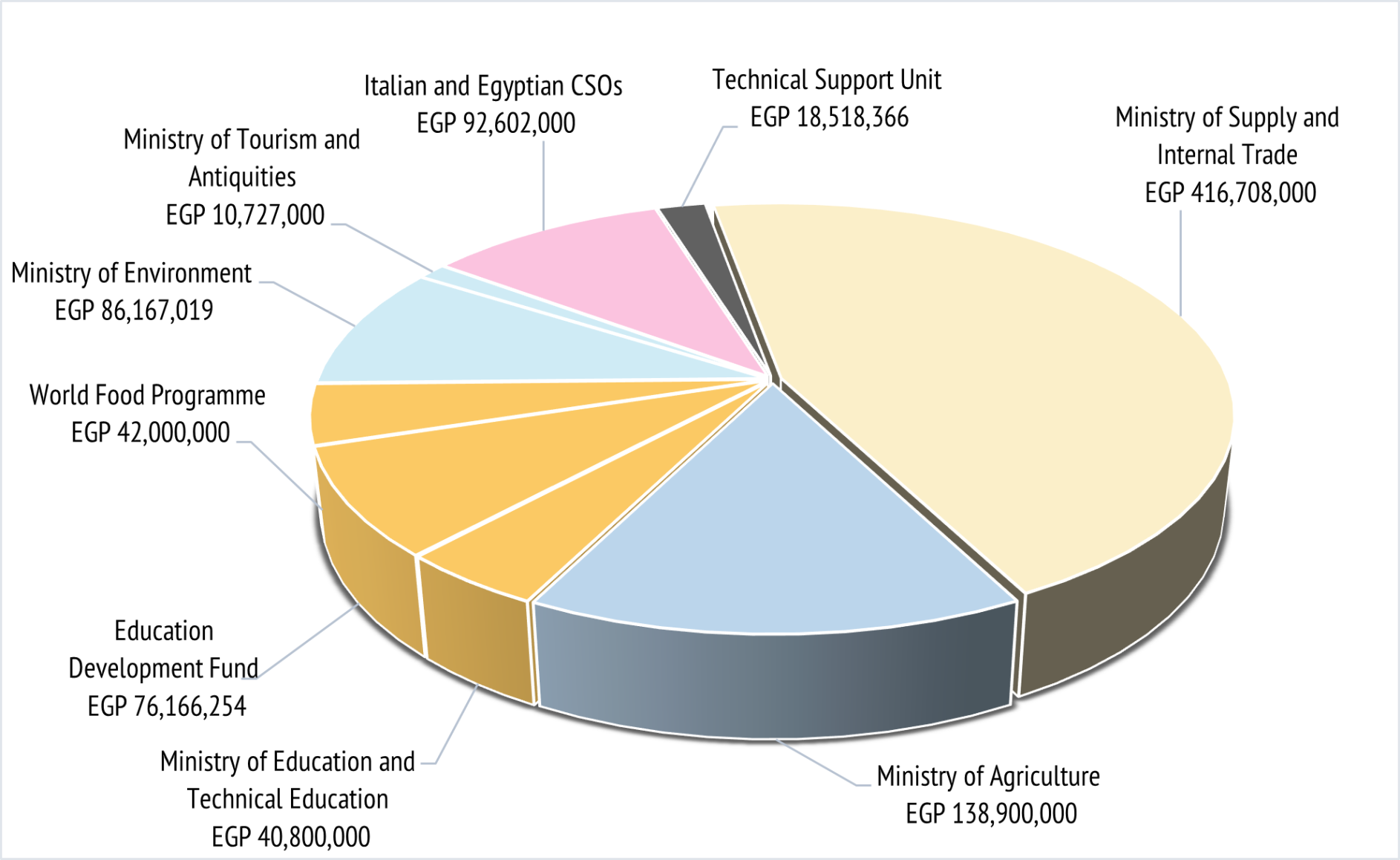

To date, all debt instalments subject to the Agreement have already been converted and transferred to the Counterpart Fund (CPF), established at the Central Bank of Egypt generating resources in local currency amounting to EGP 926,017,366.07.

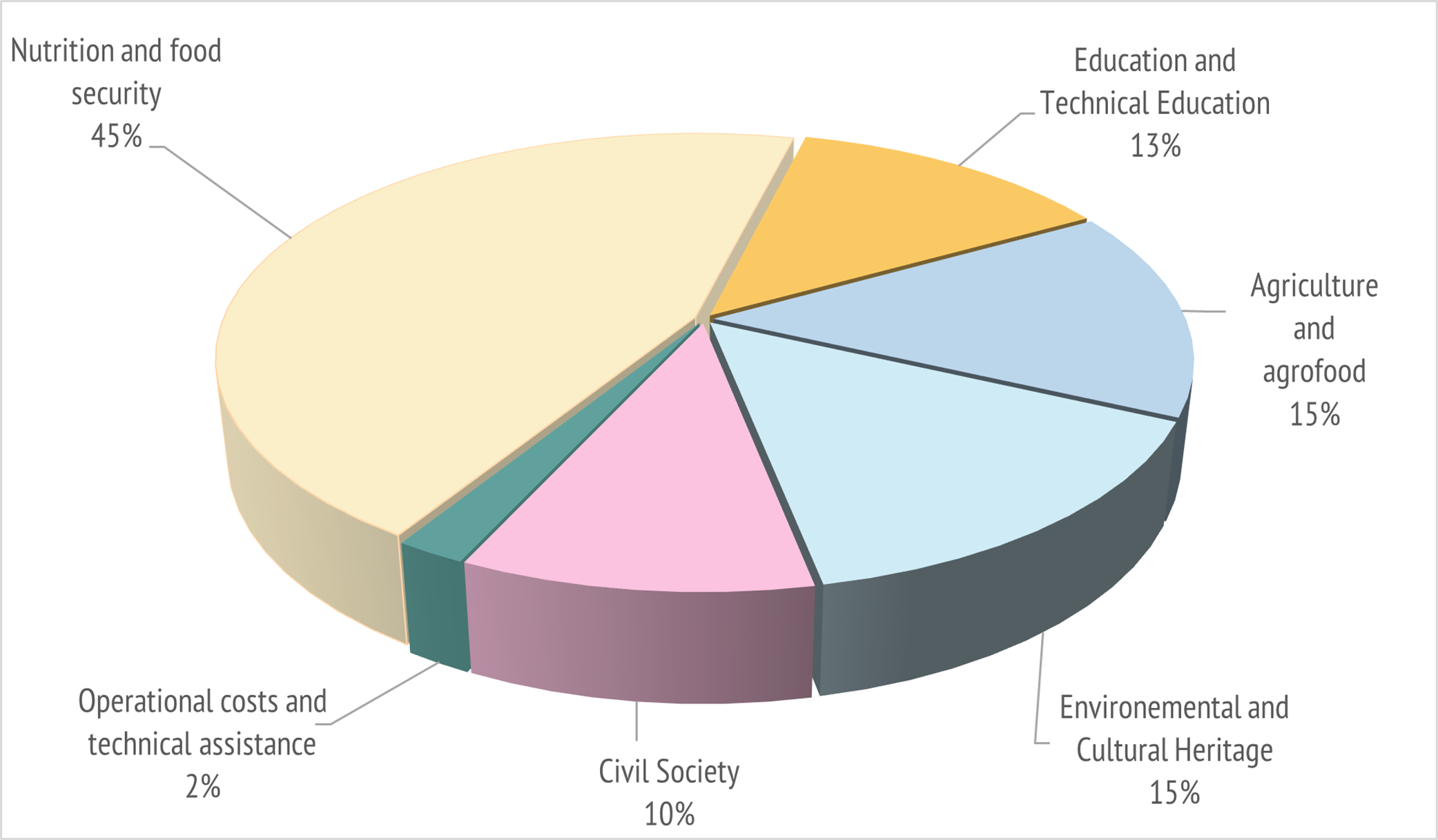

These resources are earmarked for the implementation of development initiatives jointly identified by the Parties within five priority sectors defined by the Agreement, namely:

1. Nutrition and food security, to improve food security in the Country and enhance the management of the national wheat reserves.

2. Education and vocational training, to support national school feeding programs as well as to enhance the quality of technical education delivery, mainly though establishing technical schools and encouraging their partnerships with the private sector, with the aim to prepare Egyptian students for decent jobs.

3. Agrifood sector to develop and consolidate the marine aquaculture sector in Egypt, as well as to support the production of commercial quantities of hybrid vegetable seeds with higher productivity, better quality, and greater disease resistance.

4. Environmental and cultural heritage, to preserve biodiversity in the Country’s Protected Areas, reduce climate change impact, and introduce new technologies for treatment of mixed municipal waste.

5. Civil society, to contribute to women empowerment, child protection, job creation, natural and cultural heritage preservation.

A total of twenty-three initiatives, promoted by Egyptian Ministries and public agencies, Egyptian and Italian CSOs, International Organizations, have been formalized to date, for a total value committed of EGP 887,371,964.07, inclusive of a 2% destined to cover operational and technical assistance costs managed by the Technical Support Unit of the Programme, that means the cancellation of about 96% of the resources generated by the swap activities.

In addition to the funds already committed, other resources have been preliminarily set aside for the financing of six additional initiatives, already identified and/or approved by the Management Committee, which will imply the commitment of the remaining available resources.

Against the above committed amount, as of December 31, 2023, funds worth a total of EGP 710,937,570.61 had been disbursed to the projects by the CPF, which translates into the cancellation of about 81% of the total amount of the Agreement, corresponding specifically to EUR 10,258,688.89 and USD 73,029,007.30.